What is flipping houses? Flipping houses is the process of buying properties below market value, renovating them, and then selling them for a higher price. This allows investors to make significant profits in a short period of time. This strategy requires knowledge of the real estate market, renovation skills, and the ability to make quick decisions.

In this article, the reader will learn how to start investing in flipping apartments, what steps to take to increase the chances of success, and what pitfalls may await novice investors. It also includes information on the importance of market analysis, choosing the right property, and financing a flipping project.

What is Flipping?

Flipping is an investment strategy involving buying assets with the intention of quickly reselling them for a profit, rather than holding onto them long-term to appreciate in value. Although most commonly associated with real estate and initial public offerings (IPOs), flipping can apply to a wide range of assets, including cars, cryptocurrencies, or even concert tickets.

The main goal of flipping is to achieve a quick profit. It is a strategy that requires not only good market intuition, but also the ability to react quickly to changes in the market. In the case of real estate, this may involve buying a property in need of renovation, quickly modernising it, and reselling it for a profit. In the context of IPOs, flipping investors try to acquire shares of newly listed companies in order to sell them at a higher price as soon as trading begins on the stock exchange.

However, flipping is not without risk. There is no guarantee that the asset’s price will increase in the short duration of the investment. This risk is particularly evident in the real estate market, where unexpected structural issues, market changes, or renovation delays can significantly increase costs and reduce the final profit. Similarly, in the case of an IPO, market volatility can cause the stock price to drop before the investor has a chance to sell them.

How does Apartment Flipping work?

Flipping is an investment strategy that is most commonly used in the real estate market. It involves buying properties and selling them in a short period of time (usually less than a year) to make a profit. In the context of real estate, flipping mainly takes two forms.

The first form concerns real estate investors who are looking for opportunities in rapidly growing markets and resell properties with minimal or no additional investments in the property itself. Here, predicting market trends is crucial, rather than direct value added to the property itself.

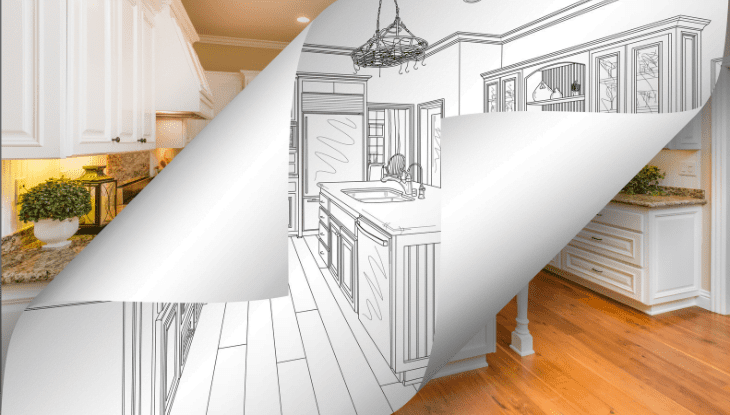

The second type is the so-called quick flipping renovation, where a real estate investor uses their knowledge of what buyers are looking for to improve the value of undervalued properties on the market through renovations or cosmetic changes. This method, also known as a reno flip, relies on the skill of quickly and efficiently carrying out renovation works that significantly increase the attractiveness and value of the property, without requiring significant investment.

Flipping Apartments – Risk

It can be a path to quick enrichment, but more often than not it produces success for television commercials rather than in reality.

Flipping in a market at its peak carries a high risk. Markets that are currently “hot” can suddenly cool down. If market conditions change before an investor has a chance to sell the property, they may end up with an asset losing value.

Flipping through improving the value of an undervalued property is less dependent on perfect market timing, but market conditions still matter.

In the case of a “reno flip”, an investor makes an additional capital investment to increase the value of the property more than the sum of the purchase costs, renovations, maintenance costs during renovations, and costs associated with finalizing the transaction.

Although flipping may seem simple and straightforward, it requires more than just a superficial knowledge of the real estate market to be profitable.

How to find houses for flipping?

Finding the right property for flipping requires a strategic approach and utilising a variety of sources of information. Beginner investors can start their search by visiting websites with court-ordered and bank auctions. There, properties can often be found at lower prices due to the financial difficulties of previous owners. These platforms, such as Foreclosures.com, can be a goldmine of opportunities, although they often require a paid subscription. Alternatively, banks and financial institutions publish lists of Real Estate Owned (REO) properties, which can also be attractive for flippers.

Another method of finding potential investments is to participate directly in enforcement and inheritance auctions. This dynamic environment offers properties at prices often significantly lower than market prices, but it requires readiness to act quickly and, in many cases, the ability to purchase with cash.

Before heading to an auction, it is worth thoroughly examining the available offers on the websites of local courts or offices. However, this method of searching for properties requires a certain amount of courage and experience, as the risk is higher here, and the competition for the best deals is fierce.

The last but equally important strategy is to build local networks by joining real estate investment clubs and collaborating with real estate agents. Investment clubs and associations are excellent places for exchanging knowledge and experiences, and they can also be a valuable source of leads.

Most common mistakes when flipping

Even experienced professionals can encounter difficulties when flipping houses. Recognising the most common pitfalls allows for avoiding them, ensuring a smoother and more profitable property renovation and sale process.

Overestimating the After Repair Value (ARV) is a trap easy to fall into, as wishful thinking about the potential selling price of a renovated property can be tempting. To avoid this, conduct thorough market research and seek the advice of a real estate expert to obtain a realistic valuation. Use data on the sales of comparable properties in the area to establish realistic expectations.

Underestimating costs is another issue. To prevent exceeding the budget, add a contingency of at least 10-20% to the estimated renovation costs to cover unexpected expenses. Start with a detailed project scope and obtain quotes from contractors. Regularly review and adjust the budget as work progresses.

Skipping an inspection may seem like a time and money saver, but it can lead to costly surprises later on. Invest in a trusted inspector to identify potential issues early. This will allow for negotiating a lower purchase price or budgeting for necessary repairs.

Summary – What is flipping houses?

Flipping houses is an undertaking that requires not only significant capital and a willingness to take risks, but also a thorough knowledge of the real estate market and skills in project management and negotiation. Success in this field depends on the ability to effectively analyse market trends, identify potential investment opportunities, and efficiently plan and execute renovation work.

Even though flipping can offer attractive profits, one should not forget about the significant risks and the possibility of losing the invested funds. This is especially important for individuals new to the real estate investment industry. Therefore, it is important to treat flipping as part of a broader, diversified investment strategy.

FAQ – frequently asked questions about what is flipping houses?

Key factors include a thorough market analysis, choosing the right property, efficient renovation management, and effective sales strategies. Add image.

Just like any investment, flipping houses comes with risks. However, thorough analysis and proper project management can significantly reduce this risk.

The duration of the project may vary, usually lasting from a few months to a year. Depending on the scale of the renovation and market conditions.

In most jurisdictions, a special license for flipping houses is not required. It’s worth checking the local regulations regarding renovations and property sales.